How Financial Advisors Illinois can Save You Time, Stress, and Money.

Table of ContentsThe Buzz on Financial Advisors IllinoisSome Ideas on Financial Advisors Illinois You Need To KnowThe Financial Advisors Illinois DiariesAll About Financial Advisors IllinoisFinancial Advisors Illinois Fundamentals ExplainedExamine This Report about Financial Advisors IllinoisWhat Does Financial Advisors Illinois Mean?

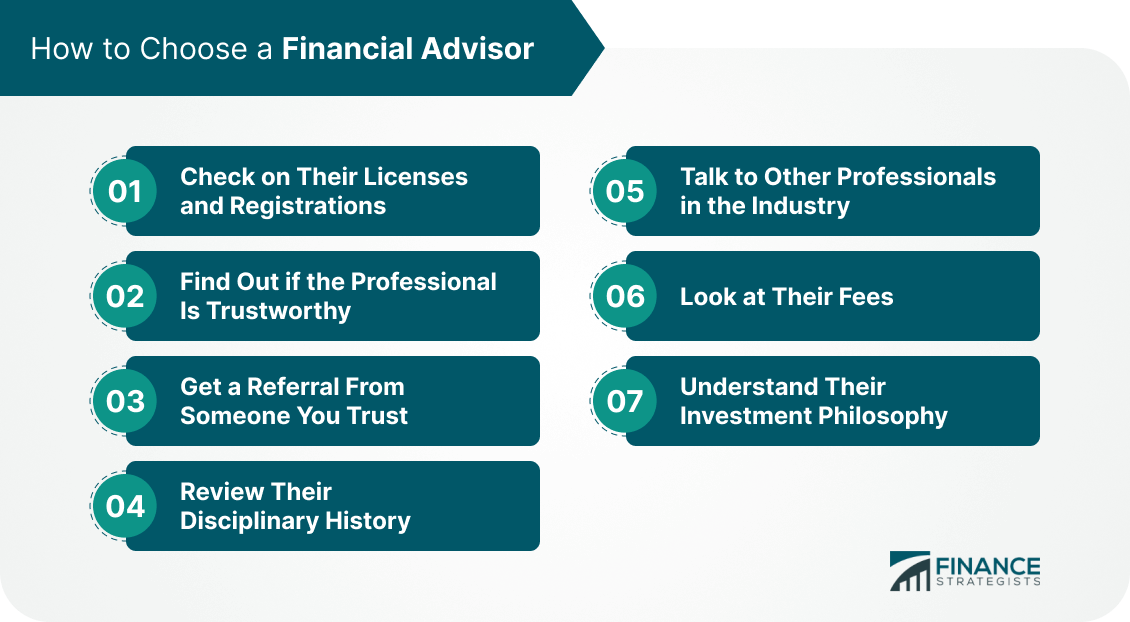

As the chart below shows, they are most thinking about getting aid getting ready for retirement and managing investments (Financial Advisors Illinois). We likewise asked if customers seek out consultants who can review investments and make profile suggestions, or are primarily curious about an expert that establishes a plan to satisfy different economic objectivesThis shows that even more customers are seeking goal-based preparation services than traditional financial investment suggestions. We asked our respondents, "Just how important is it that your consultant thinks about the ecological and social performance of the firms you will buy?" The responses shocked us. Plainly, clients appreciate ESG. They likewise respect their experts' individual values 53.8% stated an expert's personal values affect their decision to do business with the economic consultant.

Our findings recommend that the majority of customers favor a balance of online and in-person services. When we asked our respondents, "What is your recommended form of contact with a financial expert?" we found that: 52.3% choose an initial in-person meeting followed by succeeding Zoom or telephone meetings 38.9% favor in-person just In terms of meeting frequency, a plurality of respondents really felt that every 6 months was the pleasant spot although some differed.

Some Known Details About Financial Advisors Illinois

Saving for retirement in specified contribution strategies has actually created a strong desire for knowledge of retirement earnings planning. Financiers desire their advisor to consider their ESG preferences when developing a financial investment technique. More customers prefer to go to regular conferences with their consultant either via Zoom or a telephone call, however a solid majority still chooses to be literally present for initial meetings with an advisor.

This might recommend that more youthful capitalists are prone to overconfidence. Download and install the 2022 Granum Facility for Financial Protection Consumer Survey results right here.

They find out not just the principles of exactly how, yet additionally exactly how to have the discussions on the potential problems or concerns that a client will encounter., test. Financial Advisors Illinois.

The smart Trick of Financial Advisors Illinois That Nobody is Talking About

Acquiring the CFP mark shows your dedication to excellence and ethics in the field. It is the industry gold standard. Along with relevant experience and specific education needs, in order to be an acknowledged CFP specialist, success at an hours-long CFP test is required. According to the CFP Board site, "the CFP certification evaluation is a crucial requirement for achieving CFP accreditation.

Those with existing relevant levels would certainly require to add this additional education; if you can obtain it while you're getting your degree, you will conserve time. "If you have an audit level, as an example, before you rest for the CFP examination, you would certainly have to go online and take a variety of added coursework," Allen said.

CFP experts can be honored to hold out have a peek at this website this qualification. "When you're looking for profession possibilities, the most favorable aspect of the CFP designation is the bankability," Allen claimed.

"If you go apply at a firm without it, you would certainly have to pass that CFP test and prior to that, take the coursework leading up to it," Allen stated. "And that's time (the company is) waiting before generating revenue.

Financial Advisors Illinois - Truths

In contemplating the first, nevertheless, you need to think about if you would certainly appreciate establishing close partnerships with clients which may last years. Financial advisors can almost feel like component of their client's original site household.

If you're functioning with a customer on an ongoing basis, you experience those modifications with them. An occupation in personal economic planning is a mix of left and ideal mind modalities.

Monetary adjustments excellent and poor, big and tiny can have a significant emotional impact on your clients. They will need to understand you care about them and their future.

Not known Details About Financial Advisors Illinois

"Exactly how did they obtain to where they go to, why they sought me out as a CFP practitioner, and (making use of that to figure out) what can I do for them. You need to consider on your own to be a service-minded individual." Along with the different technical and logical aspects associated with education and learning and training for this occupation, the supposed "soft abilities" are also needed as an economic coordinator.

Keeping that new increased factor to consider, personal economic planners are now needed even more than ever before, to help navigate the method. "It's alright for individuals not to totally recognize whatever they need; it's too huge," Erickson claimed. "You need a financial organizer who recognizes the complexities of your demands and investments and retirements.

"I don't recognize an individual with a CFP qualification who doesn't love it, who isn't passionate in what they do," Erickson stated. "It's rather a psychological dedication. We have on-the-job experience and education and learning.

Financial Advisors Illinois - Questions

An individualized monetary plan has to do with even more than your possessions it has to do with how you invest your time, what you value, and your objectives for the future. Without actively seeking this information out, your expert won't have the ability to develop a plan that's customized to you and your demands. From the actual start, your financial expert ought to ask concerns concerning who his response you are, what you do, your existing monetary status, the monetary landmarks you wish to accomplish, and much more.

Beyond simply assisting to craft a sound financial method, asking inquiries shows that the person you're speaking to will be directly purchased and appreciate you. Besides, to the ideal financial advisor, you're more than simply the sum of your assets you're a person with your very own distinct life situations and dreams.

When accredited as an insurance coverage representative, they may recommend insurance policy options, such as life insurance coverage, wellness insurance policy, and impairment insurance, to assist shield clients and their properties.

The Ultimate Guide To Financial Advisors Illinois

They may assist with producing wills, establishing depends on, and guaranteeing a smooth transfer of riches. While economic consultants can be an important source in estate planning, they are not legal specialists and clients ought to constantly consult their lawyers when taking part in estate planning. Some economic advisors can aid clients in lessening tax liabilities by planning revenue requirements, and working with various other experts to find means to assist customers maintain even more of their hard-earned retirement dollars.

Financial consultants normally require to pass exams associated with the licenses they're going with. These exams assess their understanding of economic concepts, industry policies, and ethical guidelines. Along with passing tests, experts may require to fulfill education and experience demands. These demands may vary depending on the certificate and the state in which the advisor operates.